Mortgage calculator with remaining balance

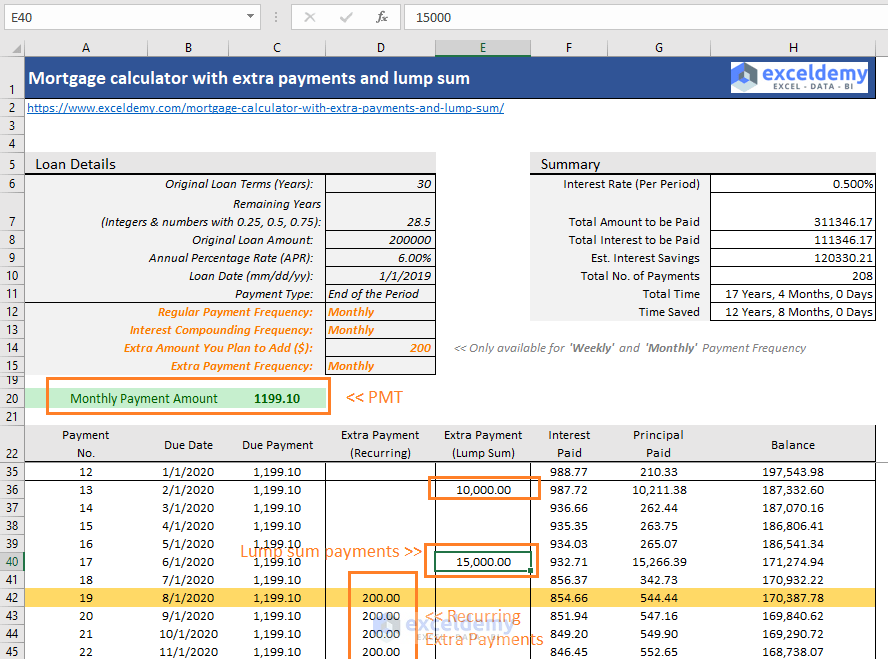

You might want to consider recasting if you happen to have large funds from inheritance pay or a windfall from a side-business. Basically your lender recalculates the remaining balance into a new amortization schedule.

Mortgage With Extra Payments Calculator

When you have a mortgage on your home the interest rate is the ongoing amount you pay to finance your home purchase.

. For example if you are 35 years into a 30-year home loan. The loan calculator also lets you see how much you can save by prepaying some of the principal. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

You can use that money to pay down other debts fund business investment or work on home improvement projects. At the close of your initial payment term it will show you exactly how much the remaining balance is on your mortgage. Your current principal balance stretches across the additional payments reducing your monthly cost.

With a 30-year fixed-rate mortgage you have a lower monthly payment but youll pay more in interest over time. Refinancing typically resets the length of your mortgage to 15 or 30 years. Pay off your mortgage early by adding extra to your monthly payments.

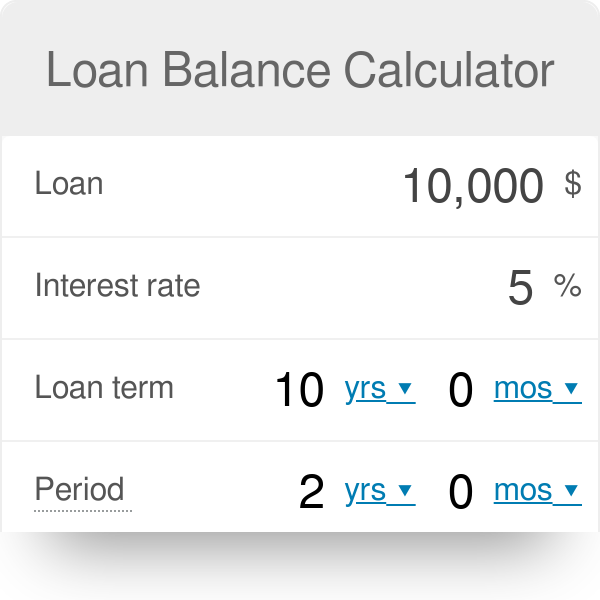

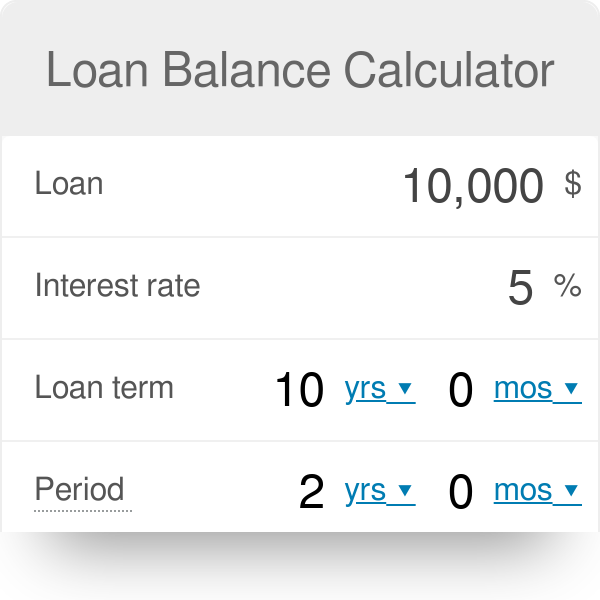

NerdWallets early mortgage payoff calculator figures out how much more to pay. The remaining balance calculator calculates the principal balance after a specified payment number. Then choose one of the three options for enteringcalculating the number of mortgage payments made leave two of the options blank and click the Calculate Mortgage Balance button to return your current balance loan payoff amount.

In effect you will be making one extra mortgage payment per year -- without hardly noticing the additional cash outflow. Yes complete amortization table. Given the figure of your anticipated monthly.

The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages. If you have a lump sum to apply to your existing mortgage amount try a cash-in refinance which reduces monthly payments further. Early Mortgage Payoff Calculator.

The most common loan terms are 30-year fixed-rate mortgages and 15-year fixed-rate mortgagesDepending on your financial situation one term may be better for you than the other. The purchase money mortgage calculator will do all the hard work for you so that you can see the numbers crunched just as they would be in this kind of near and long term mortgage. Penalty amounts are usually expressed as a percent of the outstanding balance at.

Or know how many years are ahead of you. Keep in mind that you cant transfer more than the credit limit on your new card regardless of what your old credit limit was. This free online calculator will show you how much you will save if you make 12 of your mortgage payment every two weeks instead of making a full mortgage payment once a month.

It also displays the remaining balance of the life of your loan. Enter the mortgage principal annual interest rate APR loan term in years and the monthly payment. The loan is secured on the borrowers property through a process.

If You Dont Know the Remaining Loan Term. The unpaid principal balance interest rate and monthly payment values can be found in the monthly or quarterly mortgage statement. Your interest rate is typically represented as an annual percentage of your remaining loan balance.

Or given a desired remaining balance the calculator will calculate one of the. Example if you have a four year car loan and youve made a year and a half of monthly payments 18 months this calculator will tell you the balance of the loan. The cash out option involves taking out a loan for more than the current remaining balance assuming you have built up some home equity and taking out the difference from the amount you still owe on your mortgage in cash.

Once the teaser rate expires the loan automatically shifts into a regular amortizing ARM loan. This calculator will help you determine the remaining balance on your mortgage. Under the law only conforming conventional loans can be recasted.

How to use the loan amortization calculator. PMI vs 2nd Mortgage. VA loans have unique factors that affect the accuracy of the payment including the VA funding fee VA disability rating prior VA loan usage and the loan type.

Do you want to estimate what your remaining equity balance will be a few years out from today. Those 3 numbers will be used to automatically calculate the principal interest portion of the associated mortgage loan. For example a 4 interest rate on a 200000 mortgage balance would add around 652 to your monthly payment.

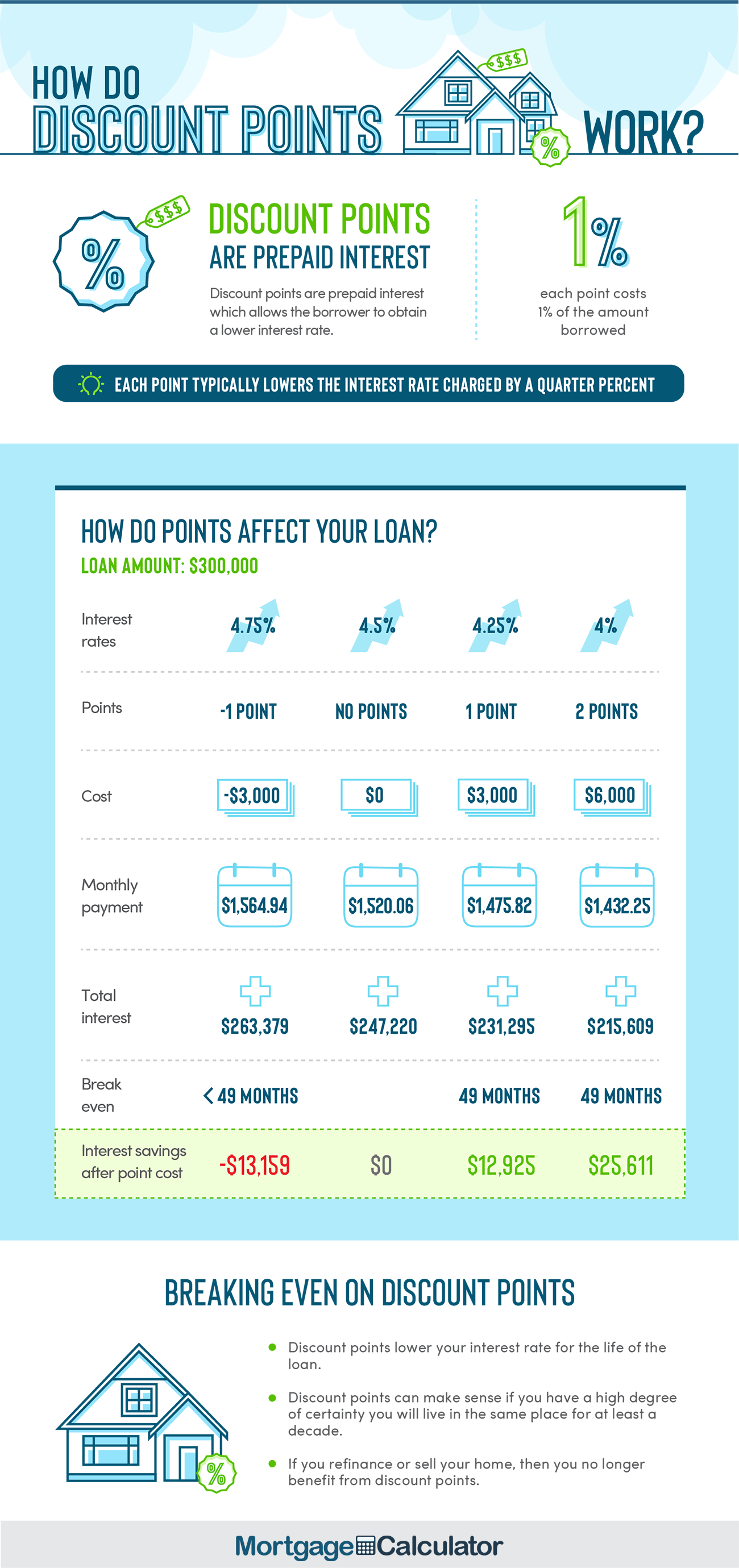

Each point lowers the APR on the loan by 18 0125 to 14 of a percent 025 for the duration of the loan. Paid during the year the remaining balance at years end and the total interest paid by the end of each year are calculated. This simple calculator will help you to evaluate your progress through the years of your home loan.

In the fields provided enter the original mortgage amount the annual interest rate and the original repayment term in years. A mortgage-backed security MBS is a type of asset-backed security an instrument which is secured by a mortgage or collection of mortgages. VA Loan Calculator vs.

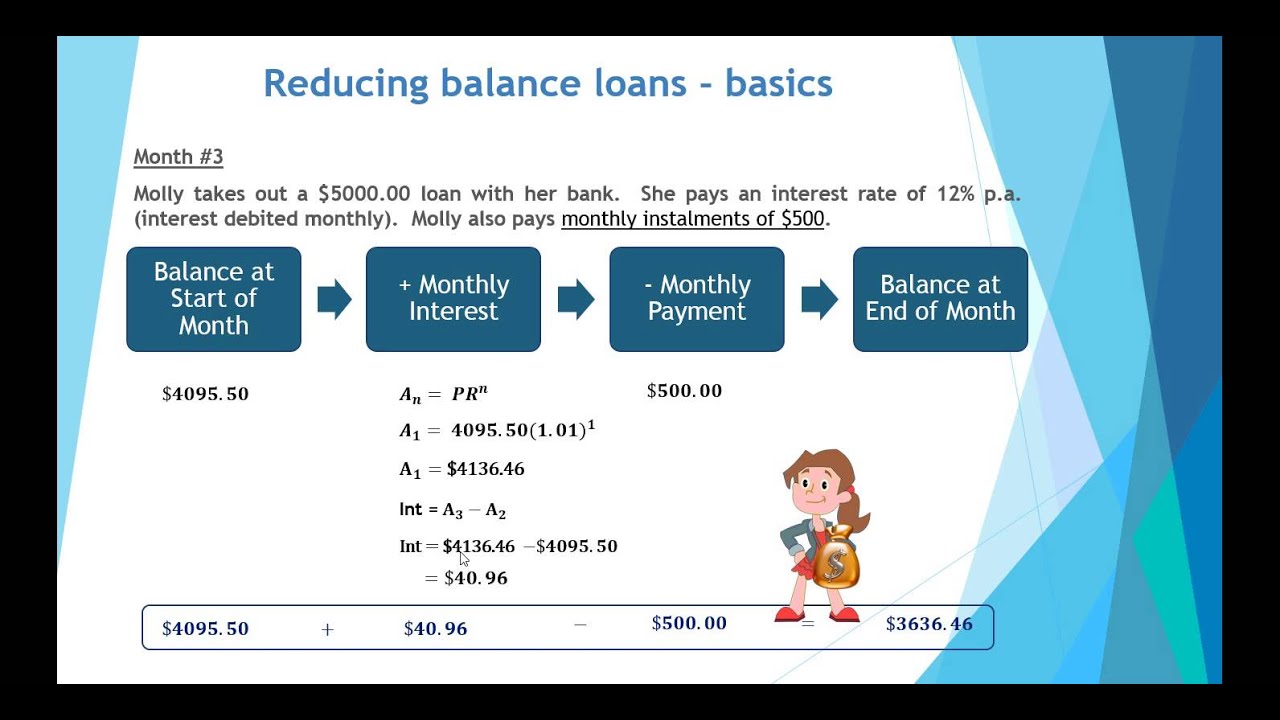

Use this free calculator to help determine your future loan balance. The interest and principal paid the remaining balance and the total interest paid by the end of each month are computed. The monthly payment and the total interest paid over the life.

Amount of the principal loan balance the interest rate the home loan term and the month and year the loan begins. Borrowers need to hold this insurance until the loans remaining principal dropped below 80 of the homes original purchase price. Fixed-Rate Mortgage Discount Points.

Use this calculator if the term length of the remaining loan is not known. Calculating monthly payments for a VA loan is similar to other mortgage options but its not the same. This tool is designed to show you how compounding interest can make the outstanding balance of a reverse mortgage rapidly grow over a period of time.

If you start making extra payments in the middle of your loan then enter the current loan balance when you started making extra payments and set the loan term for however long you have left in the loan. If you have a balance of 7500 on your existing credit card and you wish to transfer the balance to a new low-interest card that has a 6000 credit limit you can only transfer 6000 including fees to the new card. The mortgages are aggregated and sold to a group of individuals a government agency or investment bank that securitizes or packages the loans together into a security that investors can buyBonds securitizing mortgages are usually.

By taking into account the amount you borrowed the interest rate and your repayments you can work out the total amount you will repay for your loan and the remaining balance after a certain number of years. For example a 51 IO ARM would charge interest-only for the first 5 years of the loan then at that point the loan would convert into an amortizing loan where the remaining principal is paid off over the subsequent 25 remaining years of the loan.

Remaining Loan Balance Formula Car Loan Youtube

Loan Balance Calculator

Remaining Balance Calculator Financial Calculators Com

Solve For Remaining Balance Formula With Calculator

Free Interest Only Loan Calculator For Excel

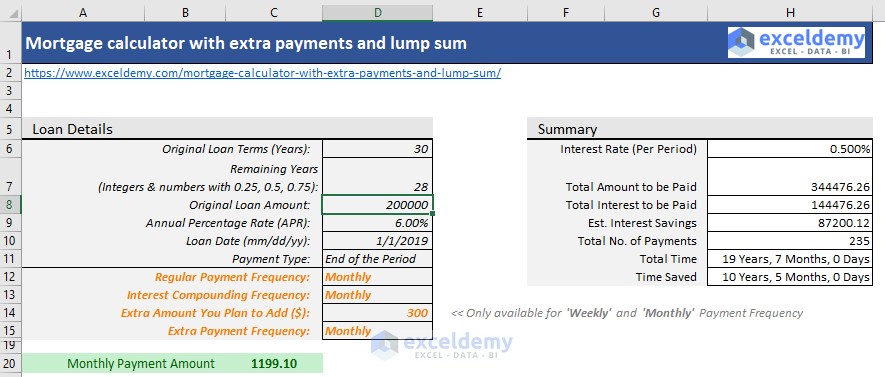

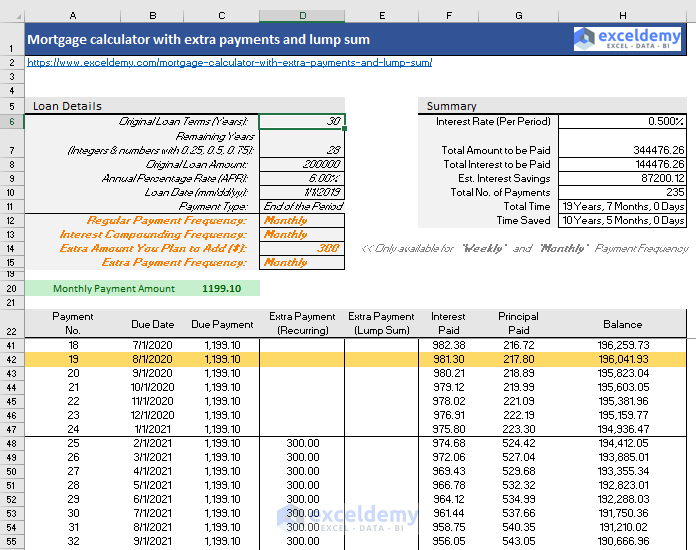

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Remaining Balance Calculator To Calculate A Loan S Payoff Amount

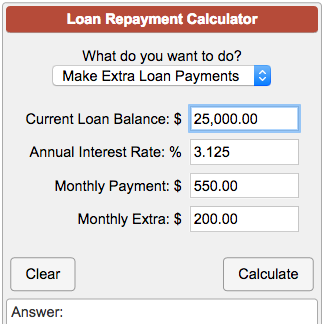

Loan Repayment Calculator

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Outstanding Principal Balance Mortgage Calculator

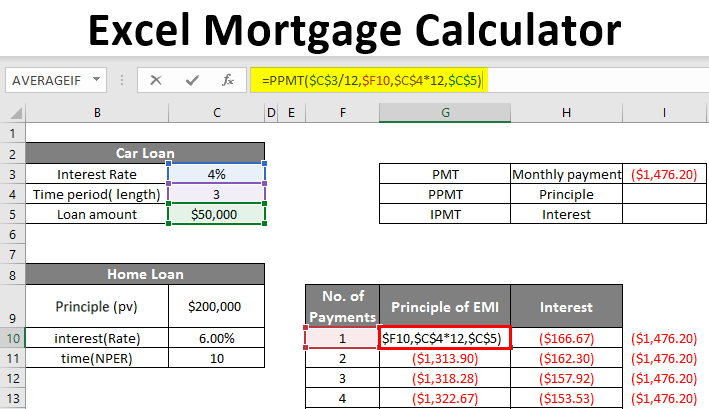

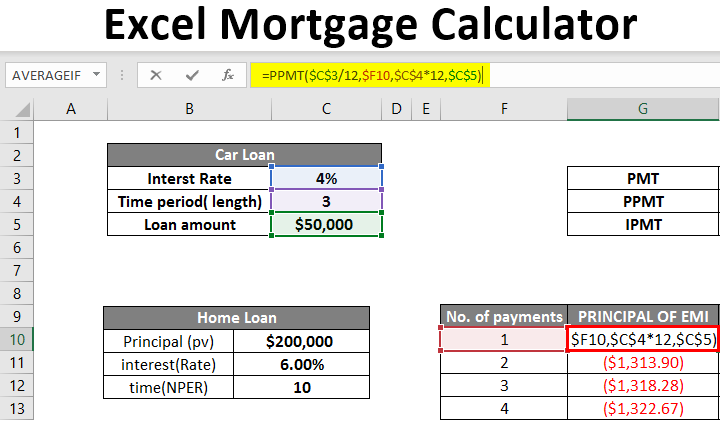

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Mortgage Calculations Using Ba Ii Plus Youtube

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Discount Points Calculator How To Calculate Mortgage Points

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

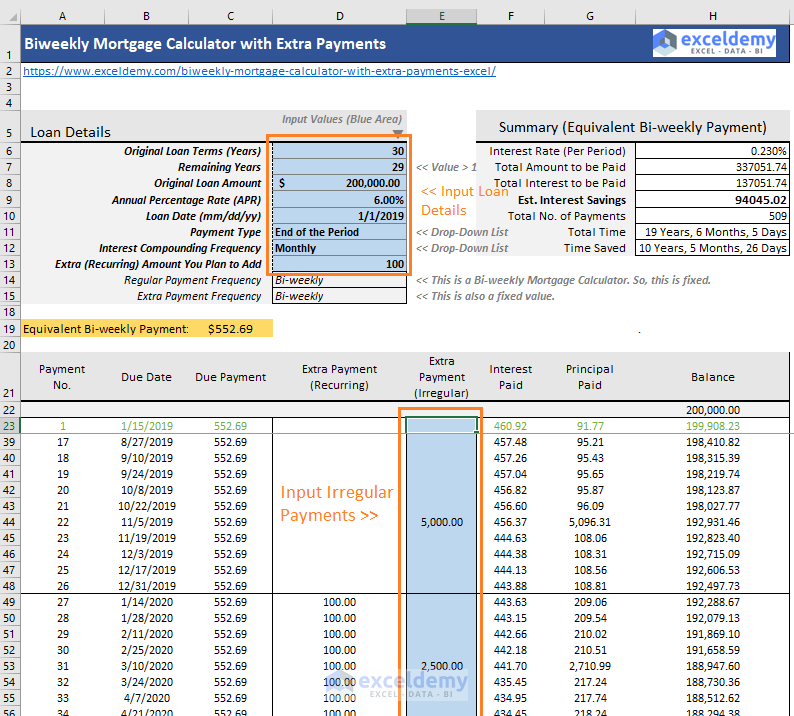

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

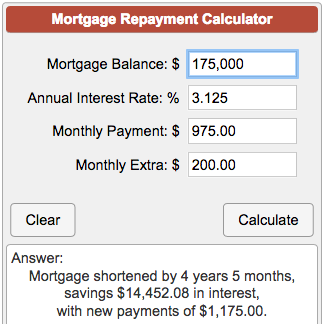

Mortgage Repayment Calculator